A Holistic Approach To Pricing Research

What We Do:

We are a different kind of market research agency consisting of successful business people and data analysts. We take a holistic approach to pricing and offer a scientific, innovative process combining data, real-life business experience, and, using the AI software we developed, to generate rapid, profitable corporate growth. We:

Conduct original pricing research into your market, customers, and non-customers.

Uncover the market’s willingness to pay for your product or service.

Accurately predict sales volume and revenue at precise price points.

Discover how product or service features, marketing channels, marketing messages, sales channels, and sales methods all affect how you can set prices to accelerate growth and profits.

What You Get:

Pricing is not just a number. Everything you do in your company affects how you can set prices. Thus, based on the research and our real life business experience, we will craft a comprehensive strategy prescriptive designed for accelerated, profitable growth consisting of:

An optimized pricing strategy based on your specific goals.

Definition of the customer profiles that fuel revenue growth and expansion.

A deep understanding of the product or service features and benefits that drive higher revenue.

Advice on the optimal marketing channels and persuasive messaging to maximize customers' willingness to pay.

Knowledge of the most effective sales channels and techniques that consistently achieve quotas.

All this will boost revenue, elevate EBITDA, and, often, increase sales volume.

Scroll down for more technical info.

Benefits of our Pricing Research Process

Scientific Pricing Methods + AI Software

= Predictable Results.

Pricing affects profitability more than cost control or sales volume increases. So, making sure your pricing is correct is obviously important, as profits are the engine that drives growth, innovation, differentiation, and corporate valuation. Simply put, you do not want to leave money on the table.

Our Pricing Research mainly uses our Predictive Sales Assessment (PSA™). This method allows us to measure discreet willingness to pay for every product, company, and customer attribute. The PSA™ method also allows us to combine these features into bundles, allowing recommendations of prices for products or services, product or service versions, and the price uplift for each feature.

The Images on the left are two examples of segmenting the baseline Predictive Sales Assessment to gain a more detailed understanding of a company’s market.

Much of the value of Pricing Research comes from how the baseline data of the Predictive Sales Assessment is segmented. Each segment consists of one answer to a question. It is essential to understand that the more questions and answers included in the Pricing Research, the more detailed the segmentation analysis can be and the more value the project will provide.

The upper images show segmentation based on the respondent's title of a B2B Pricing Research project. We can see that for this particular product, Executives/Owners/Presidents will generate the highest sales volume at relatively low prices. In contrast, Managers/Supervisors will generate the highest sales volume at relatively high prices. The company should target Managers/Supervisors as this will lead to the highest sales volume and revenue at high prices.

The lower image shows segmentation based on marketing messages in a B2C Pricing Research project. We can see that Message 1 will generate high sales volume at relatively low prices, whereas Message 2 will generate high sales volume at relatively high prices. The company should use Message 3 to ensure the highest sales volume and revenue.

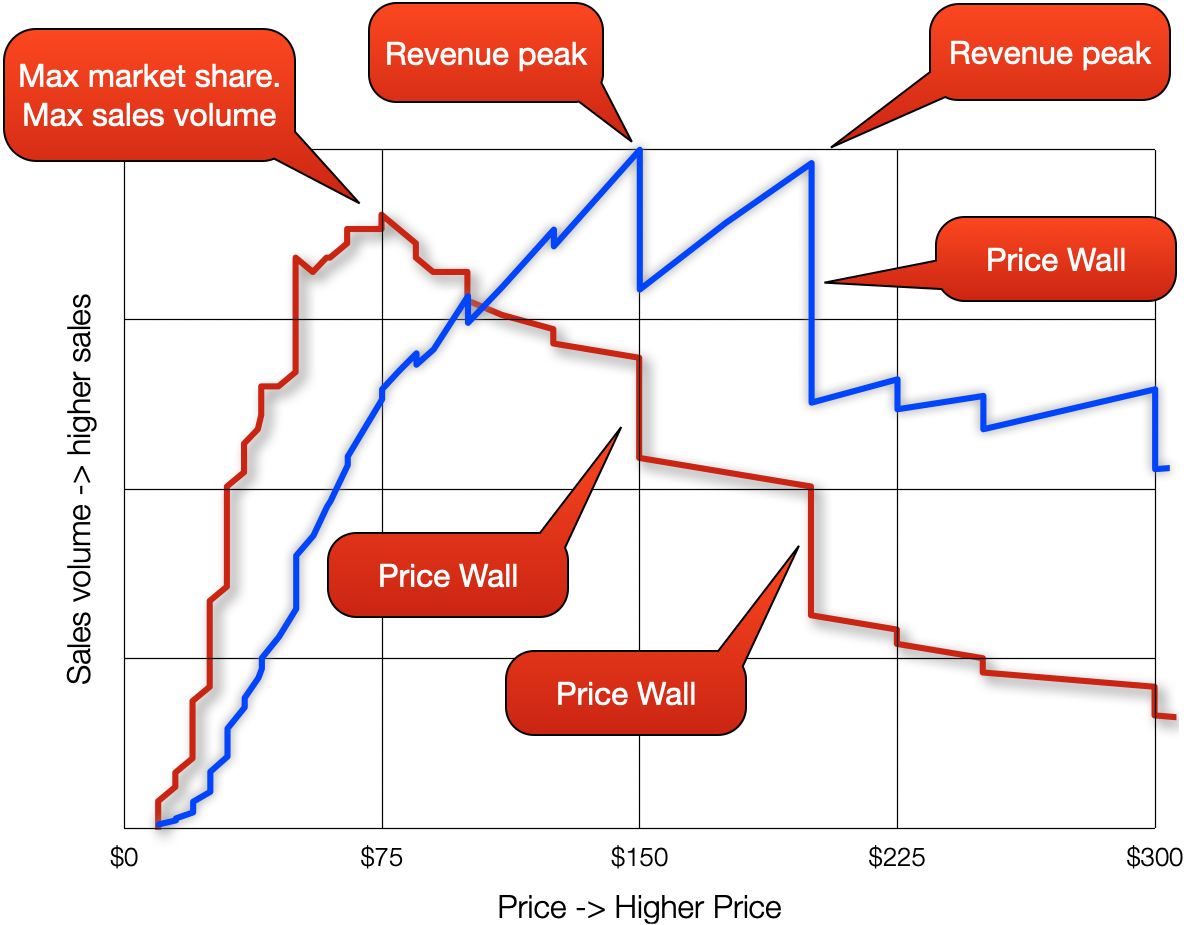

The image shows the baseline Predictive Sales Assessment. On the X-axis is the price, and on the Y-axis is the predicted sales volume and predicted revenue at different prices.

The red line shows an accurate prediction of sales volume at different prices. A few notes:

The price itself sets an expectation in the buyer’s mind about the quality and benefit of a product or service. Hence, a too-low price leads to a reduction in sales volume. A too-high price prevents a portion of potential buyers from buying; thus, higher prices also lead to lower sales volume.

Consequently, there is always a price that leads to the highest sales volume.

The blue line shows an accurate prediction of revenue at different prices. A few notes:

The price that generates the highest revenue is always higher than the price that generates the highest sales volume. Thus, companies can decide to trade sales volume for revenue.

In this example, there are two revenue peaks. This is common.

Price Walls are psychological price points that affect sales volume and revenue. You need to know the price where these price walls occur to price on the “right” side..

Respondent sourcing and qualification are crucial in Pricing Research. We use panel companies and, very occasionally, our clients’ contact lists. Respondents from panel companies can often be targeted on more than 200 variables, either B2B or B2C. The panel company distributes to the targeted audience, who will first see a project description. Some will bounce out. Those who are not will go through a series of qualification and disqualification questions designed so that only those respondents with specific domain knowledge and experience will be qualified. In consequent data processing, our AI software can identify those who were not truthful when they filled in the research instrument, and those will also be disqualified. Even after detailed respondent’ targeting, we disqualify 90 - 95% of those who enter the research project. This ensures only the “right” audience is considered.

Frequently Asked Questions

-

While many market research projects may include a pricing component, rarely is the price the main focus of such a project. Our projects, which we call Value Research, are specifically designed to measure willingness to pay in a market and further examine in detail how the market dynamics and company actions affect said willingness to pay.

-

Companies that want to successfully raise prices for an existing product or service without losing customers.

Companies that plan to expand their business into a new geographic region or country.

Companies that want to introduce a new product or service into the marketplace.

Companies that want to beat their competition.

Companies that want to identify the most effective marketing messages and marketing channels for your product or service.

Companies that want to identify market segments/verticals that want to pay for your product or service.

Companies that want to fix an underperforming product or product line.

-

It depends on your sales volume and your current price. A rule of thumb is that you will gain ten times our fees (or more) in the 12 months after our advice is implemented.

-

We have found that traditional methods of measuring willingness to pay (Conjoint Analysis, Van Westerdorp PSM, and Gabor Granger) and, thus, generating advice on pricing are not precise enough. Therefore, we developed Predictive Sales Analytics, and AI software called Predictive Sales Engine to offer a more precise alternative to traditional methods.

-

In one word: yes! If the right methods are used to measure what a market is willing to pay for a product or a service, if the data captured in the market research is qualified in many dimensions, and if it is further segmented in detail. Item description

-

Yes. There is no process difference in conducting this market research for a company selling to consumers compared to those companies selling to other companies. One restriction for companies selling B2B is that the addressable market includes more than 3,000 potential clients (5,000 minimum is better.)

-

Yes, there is no process difference in conducting this market research for a company selling products or services.

-

Yes. Companies selling to a very small market (less than 3,000 potential buyers) are unsuitable for Value Research. Likewise, companies with many SKUs (some manufacturers, retailers, distributors, and similar) will find value in a project regarding marketing and sales but not necessarily in specific pricing of a product or service.

Get in Touch.

The road to increased revenue and growth rate begins with a message from you.

Reach out to let us know how a pricing consultant can help you transform your company.