How we turn pricing questions into confident decisions

Primary quantitative research with statistically significant sample sizes, including people who didn't buy from you, reveals the exact price points your market will accept. Interpreted by business executives with real operational experience, not career consultants or fresh out of B-School MBAs.

WHAT MAKES US DIFFERENT

A price without positioning won't stick.

We identify the precise price point, attributes, features, and positioning required for market acceptance, not just a price range.

Full Market Research

Statistically significant research across qualified respondents, including non-customers, to capture exact willingness to pay across your entire market.

Attribute-Level Insights

AI-powered analysis isolates which features, benefits, and messages correlate with higher willingness to pay so you know exactly what to emphasize.

Ready-to-Implement Strategy

Specific price points plus the positioning, messaging, and feature emphasis needed for the market to accept your price. No guesswork.

THE METHODOLOGY

Predictive Demand Analysis (PDA™)

Price is only half the answer. PDA quantifies willingness-to-pay across customer segments and the things that drive value (features, benefits, and offer structure). Then we combine the data into clear recommendations for pricing, tiers, and bundles—based on real operating decision-making, not academic theory. We don't anchor research to pre-selected price points. The data reveals where demand exists, where price walls appear, and the exact optimal price. Sometimes this means raising prices; sometimes it means adjusting structure or positioning instead.

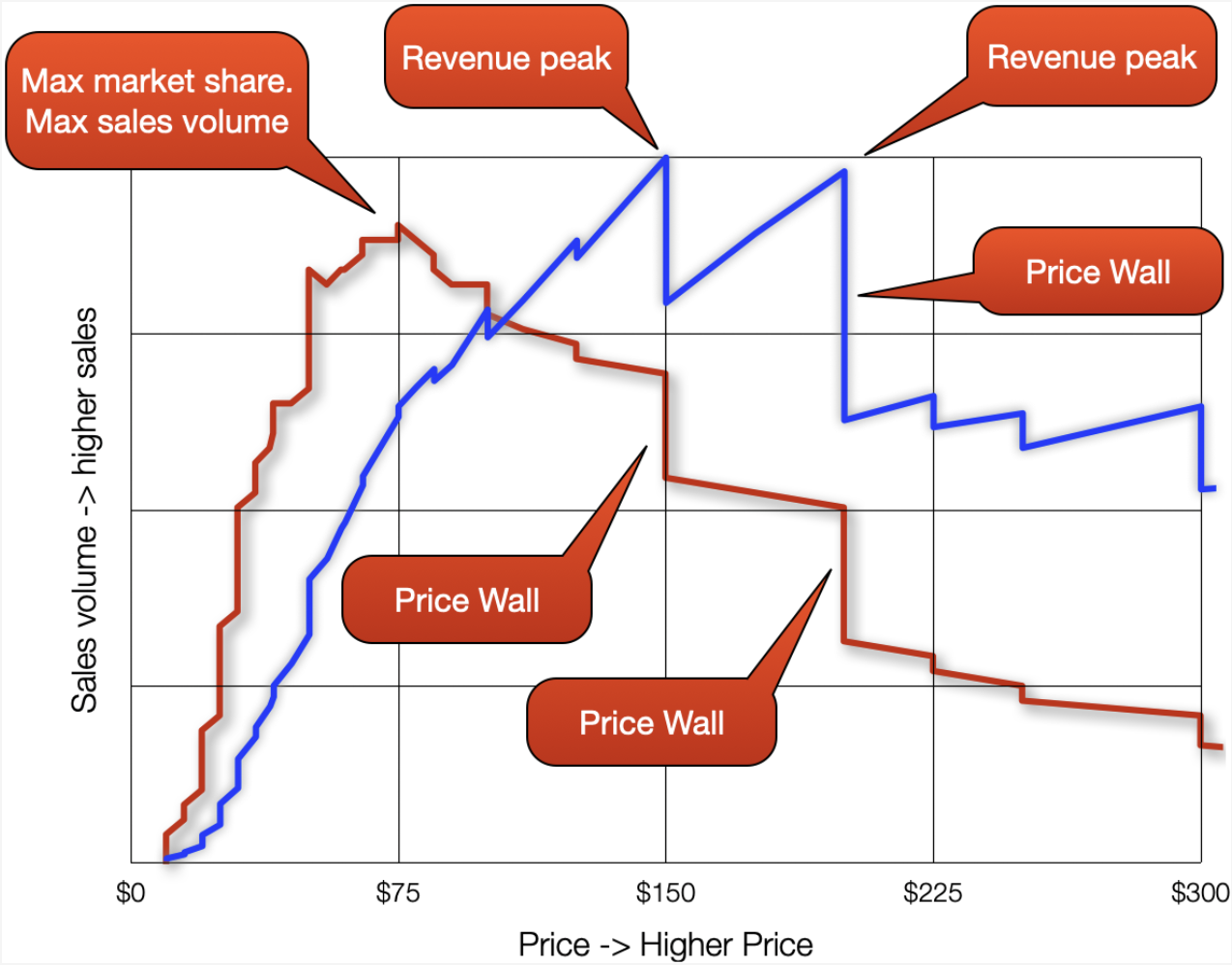

How To Read Our Charts

Red line (Sales Volume): Shows how many units you'll sell at each price point. Higher prices reduce volume because they signal premium quality and exclude price-sensitive buyers. There's always a price that maximizes volume.

Blue line (Revenue): Shows total revenue at each price point. The revenue peak is always at a higher price than the volume peak. This creates your fundamental tradeoff: maximize customers or maximize revenue.

Price Walls are psychological thresholds where demand drops sharply. Common examples: $75, $150, $225. These aren't arbitrary. They reflect how buyers categorize your offering. Price just below a wall to maximize volume, or just above to capture premium positioning.

Your Decision: This chart doesn't tell you which price to choose. It shows you the precise tradeoff at every price point so you can align pricing with your actual business goal.

The research foundation

We target exactly who matters.

Through partnerships with leading research panels (100M+ respondents globally), we apply a four-stage qualification process to ensure every response comes from a real buyer and that their data is clean enough to trust.

-

Before the a project launches, we apply hundreds of filters — firmographic, role-based, behavioral, demographic, or custom criteria — to reach only people who exactly match your buyer profile.

-

Inside the research design, we embed questions only your real market can answer: industry terminology, purchase process details, category-specific knowledge. Anyone who fails is removed before analysis.

-

We run more then a dozen AI driven data quality tests to catch bad responses: straightliners, speeders, contradictory answers, illogical patterns, and other signs of disengaged or fraudulent respondents. Flagged records are removed.

-

Only verified, engaged, and clean responses are included in the final dataset. Our Predictive Demand Engine™ models pricing only from people who actually represent your market with data you can trust.

UNCOVERING HIDDEN PATTERNS

Different buyers will pay different prices.

We segment your market by role, industry, behavior, or message exposure and measure each segment's willingness to pay.

B2B

Firmographic Industry, company size, revenue, geography, growth stage

Role-based Title, function, seniority, decision-making authority

Behavioral Tech stack, purchase history, vendor relationships, buying timeline

B2C

Demographic Age, income, household size, education, life stage, work circumstances

Geographic Region, urban/suburban/rural, climate, local market conditions

Psychographic Lifestyle, values, hobbies, interests, purchase motivations

Result: 90-95% of initial respondents are disqualified. Only qualified, engaged buyers with clean data inform your pricing.

HOW IT WORKS

The Six-Step Value Process

Step 1: Identify Challenges & Objectives

Learn your product, market, and pricing challenges to set clear objectives.

Step 2: Conduct Value Research

Survey uncovers true willingness to pay without anchoring to pre-selected prices.

Step 3: AI Analytics by Demand Engine™

AI models demand across price points and segments to reveal tradeoffs.

Step 4: Human Interpretation

Translate findings into pricing recommendations with supporting positioning, messaging, and features.

Step 5: Collaborative Action Plan

Develop a practical action plan tailored to research results and your constraints.

Step 6: Training & Implementation

Train staff and update processes to implement findings.

WHEN TO ENGAGE

Is this the right time for pricing research?

Good fit scenarios

-

Launching something newNew product or service, new market, or tier and you want to price it right from the start

-

Considering a price increaseYou want to know how much room you have and how to position it to maximize return without alienating customers

-

Revenue is stallingPricing may be the lever you haven't fully tested

-

Preparing for investmentInvestors and boards want evidence your pricing can scale

-

Market dynamics have shiftedCompetitive landscape changed or you need to understand how your market perceives value vs. alternatives

Not a fit if

-

Addressable market under 3,000 potential customersWe need statistical significance for reliable insights

-

Looking for a one-time number without positioning guidanceOur value comes from the complete strategy, not just a price point

-

No internal capacity to implement pricing changesResearch without implementation wastes the investment

-

Pricing is fixed by regulation or long-term contractsIf you cannot adjust pricing, research findings cannot be applied

-

Need results in under 4 weeksRigorous research, analysis, and strategy development requires adequate time

Ready to see exactly what your market will actually pay?

Bring the pricing decision you're facing. We'll confirm feasibility and scope the fastest path to a clear recommendation.

BOOK A 15-MINUTE PRICING CONSULTATION

What happens on the call:

We assess fit (market size, decision timeline, implementation capacity)

You share the pricing decision you're facing

We outline what we'd measure (segments, messages, attributes)

You leave knowing whether this is worth pursuing